Introduction

Overview of the fintech landscape in Nigeria

Nigeria’s fintech industry has transformed rapidly over the last decade.

Innovations have emerged, targeting millions of unbanked individuals.

Today, Nigeria boasts several successful fintech startups and platforms.

Companies like Paystack and Flutterwave have revolutionized payment processing.

These solutions cater to a growing demand for financial inclusion.

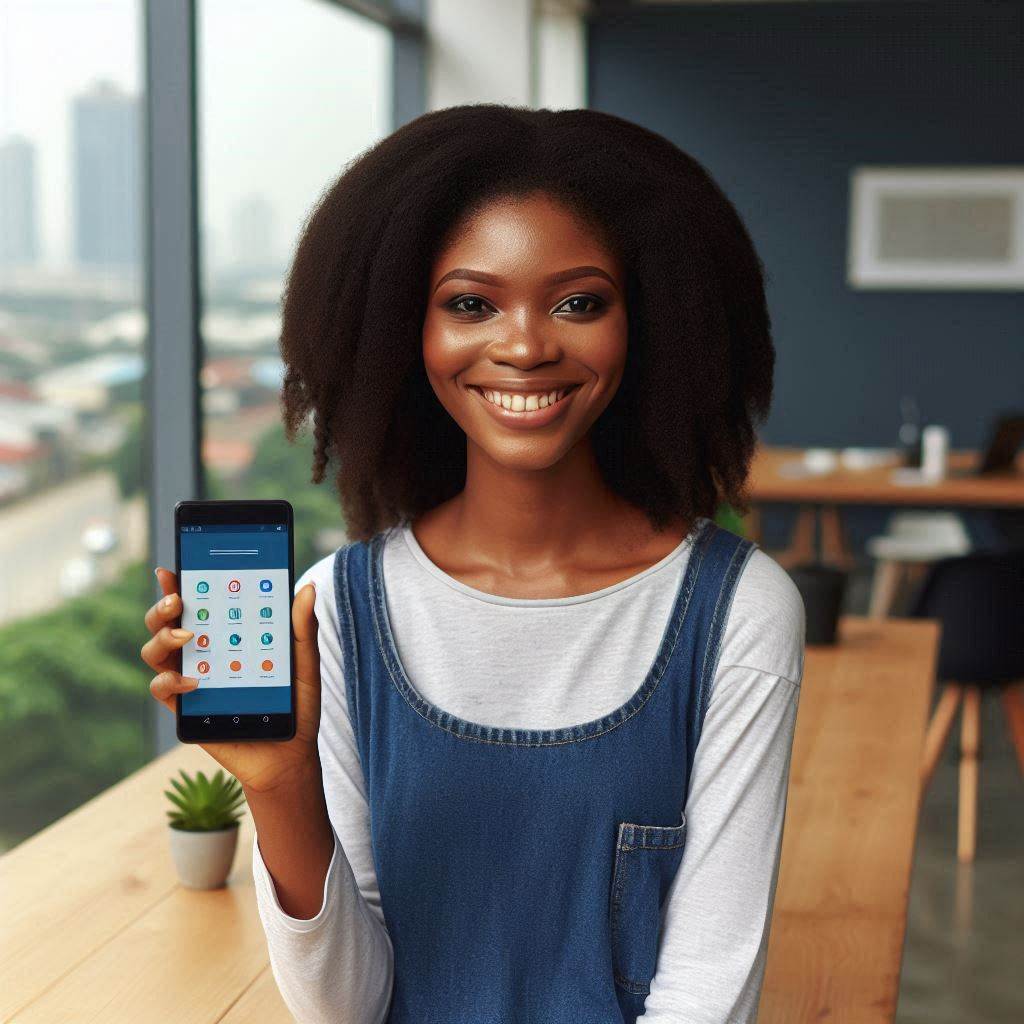

Increased smartphone penetration greatly supports this growth.

As a result, Nigerians are increasingly turning to digital financial services.

Importance of mobile applications in the financial sector

Mobile applications play a crucial role in the financial sector.

They enhance accessibility to banking services for users across Nigeria.

Many individuals rely on their smartphones for transactions, bill payments, and investment management.

Mobile apps provide a user-friendly interface that customers appreciate.

These applications also offer convenience and time savings, making them popular.

Additionally, they allow users to manage their finances with greater control.

Security features within these apps help build trust among users.

Overall, mobile fintech apps promote financial literacy and inclusivity.

Brief introduction to Flutter as a cross-platform development framework

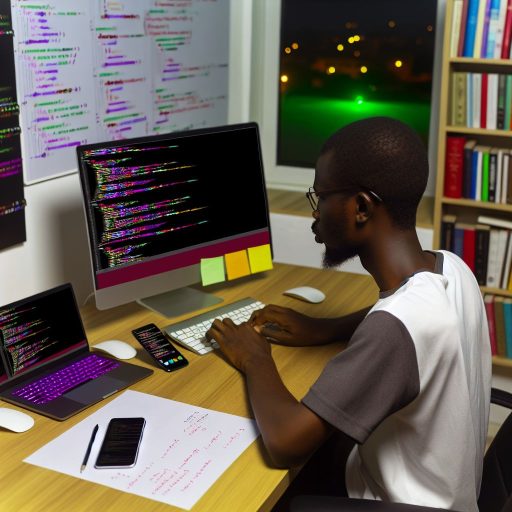

Flutter has emerged as a powerful tool for developers.

Google’s open-source framework simplifies building beautiful applications for multiple platforms.

Flutter allows developers to write code once and deploy it across iOS and Android.

This efficiency reduces development time, which is vital for startups.

Its widget-based architecture offers a customizable and visually appealing user experience.

Furthermore, Flutter’s strong community support enhances development resources.

Developers can easily access plugins and libraries that streamline the process.

As a result, more fintech startups in Nigeria adopt Flutter for their applications.

In essence, the fintech landscape in Nigeria presents immense opportunities for growth.

Mobile applications are at the core of this transformation, enhancing financial access.

Flutter, as a cross-platform development tool, empowers developers to create impactful solutions.

Embracing these innovations can help shape the future of finance in Nigeria.

Understanding Flutter

Definition and purpose of Flutter

Flutter is an open-source UI toolkit developed by Google.

It allows developers to create natively compiled applications for mobile, web, and desktop from a single codebase.

The main purpose of Flutter is to simplify mobile app development.

It achieves this by offering tools that support fast and efficient coding.

Developers can create beautiful UIs with less effort.

Flutter focuses on high performance and responsiveness.

It also provides a rich set of pre-designed widgets that adhere to specific design languages.

Key features of Flutter that make it ideal for fintech app development

- Hot Reload: Flutter’s hot reload feature allows developers to see changes instantly.

This speeds up development and enables quick iteration. - Rich Widget Library: Flutter offers a vast library of customizable widgets.

These widgets help developers design visually appealing user interfaces. - Cross-Platform Compatibility: Developers can write code once and deploy on multiple platforms.

This reduces development time and costs significantly. - Excellent Performance: Flutter compiles to native ARM code.

This ensures smooth performance on both iOS and Android devices. - Strong Community Support: Flutter has a growing community that contributes tutorials, plugins, and packages.

This enhances the overall development experience. - Integrated Testing Framework: Flutter provides testing at various levels.

This ensures a quality user experience in fintech applications. - Adaptability: Flutter apps can easily adapt to different screen sizes and orientations.

This is crucial for accessibility in fintech apps. - Support for Firebase: Integrating Firebase is straightforward with Flutter.

This allows for real-time database functionalities, which are vital for financial apps.

Comparison with other development frameworks like React Native and native iOS/Android

When considering app development, it’s essential to compare different frameworks.

Flutter, React Native, and native development each have distinct advantages and disadvantages.

React Native vs. Flutter

- Performance: Flutter offers superior performance due to its direct compilation into native code.

React Native relies on a JavaScript bridge, which can slow down performance. - User Interface: Flutter’s widget-based architecture allows for consistent UIs across platforms.

React Native relies on native components, which may differ between platforms. - Development Speed: Flutter’s hot reload features make development faster.

React Native also supports hot reloading, but Flutter’s implementation is typically smoother. - Job Market: React Native has been around longer, leading to a larger pool of developers.

However, Flutter is quickly gaining popularity, particularly for fintech apps. - Learning Curve: Flutter uses Dart, which may be new to developers.

React Native uses JavaScript, which many developers already know.

Flutter vs. Native iOS/Android

- Development Time: Flutter reduces development time with a single codebase.

Native development requires separate code for iOS and Android, increasing time and costs. - Access to Native Features: Native development provides full access to platform-specific features.

Flutter also offers access but may require native code for some functionalities. - Performance: Native applications generally perform better.

However, Flutter’s performance is often close, making it suitable for high-performance apps. - UI Flexibility: Flutter’s widget library offers extensive UI customization.

Native development allows custom UI but requires more effort and expertise. - Community and Resources: Native development has a more established community and resources.

Flutter has significant resources but is rapidly growing as a contender.

Basically, Flutter brings numerous advantages that appeal especially to fintech developers.

Its rich set of features, including hot reloading and cross-platform capabilities, streamline the development process.

Compared to React Native and native development, Flutter provides unique benefits.

Its growing community and extensive resources continue to support its expansion in the fintech app domain.

Embracing Flutter for fintech applications in Nigeria offers significant potential.

The rapid growth of fintech in the region creates a demand for innovative solutions.

Developers can leverage Flutter to meet these needs efficiently.

By understanding the core features and advantages, they can build functional, user-friendly apps that resonate with Nigerian users.

As fintech continues to evolve, staying updated with development frameworks is crucial.

Flutter’s adaptability and performance make it a fantastic choice for future projects.

With ongoing improvements and community support, Flutter is likely to remain a frontrunner in fintech app development.

The Rise of FinTech in Nigeria

Growth Statistics and Recent Trends in Nigeria’s FinTech Industry

Nigeria’s FinTech sector has experienced tremendous growth in recent years.

According to recent reports, the total funding in FinTech reached over $1.4 billion in 2021.

This figure marks an increase of over 300% when compared to previous years.

The country now boasts over 200 FinTech startups.

These startups cater to various financial services, from payments to lending and investment management.

The Central Bank of Nigeria (CBN) has played a key role in this growth.

Its regulatory framework encourages innovation and supports the digital economy.

In 2020, the CBN released a roadmap for the digital financial landscape.

This move has paved the way for more startups to enter the market.

Mobile payments have taken center stage in Nigeria’s FinTech revolution.

Recent trends show that over 50% of transactions now occur via mobile devices.

This shift reflects the increasing smartphone penetration in the country.

Analysts expect the number of active mobile payment users to double by next year.

The emergence of digital banks also marks a pivotal trend.

These banks operate entirely online, eliminating traditional banking obstacles.

They offer services like savings, loans, and investments without physical branches.

Furthermore, blockchain technology is gaining traction.

More companies are exploring blockchain for secure transactions and smart contracts.

This technology enhances transparency and reduces fraud risks, crucial in Nigeria’s financial landscape.

Key Challenges Faced by Traditional Banks and How FinTech Addresses These Issues

Traditional banks in Nigeria face numerous challenges.

These challenges hinder their ability to meet customer demands effectively.

Here’s a closer look at some of these challenges:

Unlock Your Unique Tech Path

Get expert tech consulting tailored just for you. Receive personalized advice and solutions within 1-3 business days.

Get Started- Inaccessibility: Many Nigerians lack access to banking services.

Rural areas especially suffer from this problem. - High Operational Costs: Running physical branches incurs high costs.

Traditional banks pass these costs onto customers, resulting in higher fees. - Slow Service Delivery: Long waiting periods and bureaucratic processes frustrate customers.

Traditional banking systems often lack efficiency. - Limited Innovation: Slow adoption of technology hampers service enhancement.

Traditional banks struggle to provide innovative services.

FinTech companies address these challenges effectively:

- Accessibility: FinTech solutions often provide services via mobile apps.

This enables users in remote areas to access banking services. - Cost Efficiency: Digital transactions reduce operating costs.

FinTech companies can offer lower fees, benefiting consumers. - Faster Service: Automated systems streamline processes.

Customers can conduct transactions quickly and without delay. - Continuous Innovation: FinTech companies continually adapt and innovate.

They can quickly roll out new features and services.

By addressing these challenges, FinTech companies gain traction among Nigerian consumers.

They create a competitive landscape that forces traditional banks to adapt and innovate.

Customer Demand for Innovative Financial Solutions

As technology evolves, so does customer demand for more convenient financial solutions.

Nigerians increasingly seek accessible and efficient banking options.

Trends indicate a significant shift in customer preferences:

- Preference for Mobile Banking: Customers prefer managing finances through mobile apps over in-person visits to banks.

- Instant Gratification: Modern consumers expect swift responses and immediate resolution of financial issues.

- Personalized Services: Customers demand tailored financial products that suit their unique needs.

- Financial Inclusion: There is a growing need to include unbanked populations in the financial system.

Innovative solutions foster inclusion.

This demand drives FinTech companies to create products that resonate with consumers.

Services like digital wallets, peer-to-peer payments, and microloans are popular.

These solutions offer users flexibility and convenience previously inaccessible.

Moreover, customer education plays a crucial role.

Many FinTech companies focus on imparting knowledge about financial products.

This effort fosters trust and promotes healthy financial behaviors among users.

As customers encounter these innovations, they embrace FinTech with enthusiasm.

The focus on user experience and seamless transactions enhances customer satisfaction.

Therefore, the FinTech sector in Nigeria flourishes amidst significant growth and transformation.

With over $1.4 billion in funding and a burgeoning startup ecosystem, the landscape is ripe for innovation.

Traditional banks must adapt to surmount their challenges and meet shifting consumer demands.

FinTech companies, on the other hand, have emerged as key players, addressing these needs effectively.

The demand for innovative solutions continues to grow as Nigeria’s economy embraces digital finance.

The future promises exciting possibilities for both consumers and developers alike.

Read: Build Stunning Mobile Apps: A Guide for Nigerian Coders

Essential Features of FinTech Apps

Creating a successful FinTech app requires attention to several critical features.

A well-designed app caters to user needs while ensuring compliance and security.

Below are some essential features that can enhance the functionality and appeal of FinTech applications.

User-friendly interface and user experience

Every FinTech app must prioritize user interface (UI) and user experience (UX).

A well-crafted UI/UX design significantly impacts user satisfaction.

Consider the following elements:

- Intuitive Navigation: Users should easily move through the app without confusion.

Logical layouts guide them seamlessly. - Visual Appeal: Use aesthetically pleasing colors and designs.

This will captivate users and encourage them to engage further. - Responsive Design: Optimize the app for various devices.

Ensure users can access its features on smartphones and tablets alike. - User Onboarding: Develop a straightforward onboarding process.

This helps users understand the app and its features quickly. - Feedback Mechanism: Allow users to provide feedback.

Implementing feedback shows that you value user opinions and improves overall experience.

Security features essential for financial transactions

Security is paramount for any FinTech app.

Users must trust that their financial information is safe.

Below are crucial security features to implement:

- Data Encryption: Encrypt all sensitive data during transmission and storage.

This protects user data from unauthorized access. - Multi-Factor Authentication (MFA): Require MFA for user login.

This adds an extra security layer, significantly reducing fraud risk. - Secure Socket Layer (SSL) Certification: Implement SSL to establish a secure connection between the server and users.

- Fraud Detection: Integrate algorithms to monitor irregular transaction patterns.

Alerts help prevent unauthorized transactions in real time. - Regular Security Audits: Schedule routine security checks and penetration testing.

Regular updates will ensure ongoing protection against new threats.

Integration of payment gateways and financial APIs

Integrating reliable payment gateways can streamline transaction processes.

A variety of gateways are available for use.

Key components include:

- Seamless Transactions: Ensure transactions occur smoothly without delays.

This improves user satisfaction and trust. - Support for Multiple Payment Methods: Include options like credit cards, mobile wallets, and bank transfers.

This variety accommodates user preferences. - Automated Reconciliation: Integrate technologies that automate transaction reconciliation.

This reduces human errors and enhances operational efficiency. - Instant Notifications: Implement real-time notifications for transaction completion.

This keeps users informed and promotes transparency. - Support for International Payments: Facilitate cross-border transactions.

This expands user reach and adapts to the global financial landscape.

Real-time data analytics for user insights

Data analytics plays a vital role in enhancing your FinTech app.

Utilize insights to improve user experiences and drive engagement.

Key aspects include:

- User Behavior Tracking: Monitor how users interact with the app.

Use this data to identify popular features and areas for improvement. - Personalized Recommendations: Leverage analytics to offer tailored suggestions to users.

This creates a more engaging and user-centric experience. - Market Trends Analysis: Stay updated on emerging trends in the financial sector.

This helps to keep your app relevant and competitive. - Real-Time Reporting: Provide users with access to real-time financial reporting.

This empowers them to make informed financial decisions. - Customer Segmentation: Use analytics to categorize users based on behaviors and preferences.

This can lead to targeted marketing strategies and increased retention.

In short, the essential features of FinTech apps include a user-friendly interface, robust security measures, seamless payment integration, and real-time data analytics.

By focusing on these aspects, developers can build powerful apps that resonate with the Nigerian audience.

Prioritizing these features will help ensure your FinTech application not only meets user needs but also stands out in a competitive market.

With the right blend of functionality and design, your app can empower users and establish a strong presence in the financial technology space.

Unlock Premium Source Code for Your Projects!

Accelerate your development with our expert-crafted, reusable source code. Perfect for e-commerce, blogs, and portfolios. Study, modify, and build like a pro. Exclusive to Nigeria Coding Academy!

Get CodeRead: Best Programming Languages Nigerians Must Learn in 2024

Steps to Building a FinTech App Using Flutter

Defining the app’s purpose and target audience

Before diving into app development, it’s crucial to define your app’s purpose.

Every successful FinTech app solves specific problems for its users.

Start by conducting market research to identify gaps in current financial services in Nigeria.

This will help you understand the needs of users and the challenges they face.

Next, determine your target audience.

Consider demographics such as age, occupation, and financial literacy.

A well-defined audience will guide your design choices and service offerings.

Create user personas to visualize your typical users.

This can enhance your design decisions and features.

List some potential purposes for your app:

- Facilitating digital payments.

- Providing investment opportunities for users.

- Offering personal finance management tools.

- Improving access to microloans.

Identify which functionalities resonate most with your audience.

This clarity will keep your development focused.

Setting up the Flutter development environment

Once you have a clear purpose and audience, setting up your development environment is the next step.

Flutter is versatile but requires specific tools to develop effectively.

First, you need to install Flutter SDK on your machine.

Follow these steps to set up Flutter:

- Download the Flutter SDK from the official website.

- Extract the downloaded files to a suitable location.

- Add the Flutter bin directory to your system path.

- Run the command “flutter doctor” in the terminal to check for issues.

- Install the required IDE (VS Code or Android Studio) for development.

Ensure that you also have the Dart language installed.

Dart comes bundled with Flutter when you install it.

Familiarize yourself with Dart, as it’s essential for Flutter development.

Setting up an emulator or connecting a physical device for testing is also necessary.

Make sure to enable USB debugging on your device for testing purposes.

Once your development environment is ready, you can start building your app.

Designing the app UI with Flutter widgets

The design phase is critical for FinTech apps.

Users appreciate intuitive and responsive interfaces.

Flutter provides a wide range of widgets to help you build stunning UIs.

Familiarize yourself with basic and advanced widgets.

Some essential Flutter widgets include:

- Container: Use for layout and styling.

- Row and Column: Utilize for organizing content.

- ListView: Perfect for displaying lists of items.

- Form: Manage user inputs effectively.

Keep these design principles in mind:

- Prioritize simplicity to enhance usability.

- Ensure colors and fonts align with your brand identity.

- Make navigation intuitive for a seamless 사용자 experience.

- Implement responsive design for different devices.

Consider involving a UI/UX designer in your process.

They can contribute valuable expertise in creating a user-friendly experience.

Regularly gather feedback during the design process.

Early testing allows you to make necessary revisions based on user input.

Implementing business logic and connecting to back-end services

After designing your UI, it’s time to implement business logic.

Business logic is crucial as it determines how your app behaves under various scenarios.

Define workflows, data flows, and how user inputs trigger specific actions.

Utilize Dart programming language for your business logic.

Ensure that the logic handles errors efficiently.

Proper error handling enhances user experience by managing failures gracefully.

Connecting your app to back-end services is essential for functionalities like user authentication, data storage, and transaction processing.

Consider using platforms like Firebase or AWS.

These services simplify backend integration and scaled data management.

Follow these steps to connect to back-end services:

- Choose a back-end platform that suits your app needs.

- Create an API to facilitate communication.

- Use HTTP requests to connect the app with your back-end.

- Handle user authentication using available libraries.

- Integrate real-time database options if necessary.

Secure data transmission by implementing HTTPS and encrypting sensitive information.

This is particularly vital for FinTech applications that manage personal and financial data.

Testing for functionality, performance, and security

Finally, comprehensive testing is crucial to ensure your app works flawlessly.

Testing should encompass functionality, performance, and security aspects of your app.

Use Flutter’s built-in testing framework for this purpose.

Consider the following types of testing:

- Unit Testing: Verify individual components work as intended.

- Integration Testing: Ensure different parts of the app function well together.

- Widget Testing: Validate UI functionalities.

Additionally, carry out performance tests.

Assess how the app performs under load, especially during peak usage.

Identify load times and responsiveness to ensure a smooth experience.

Security testing is non-negotiable.

Adopt best practices in security to protect user data.

Perform penetration testing to identify potential vulnerabilities.

Regular updates and patches will also keep your app secure against emerging threats.

Compile user feedback to address issues or needed improvements.

Continuous improvement is key to retaining users in the competitive FinTech landscape.

Following these steps will allow you to develop a FinTech app using Flutter.

Each phase is integral to building a successful product.

By focusing on your target audience, designing efficiently, implementing robust logic, and rigorous testing, you’ll create an app that not only meets but exceeds user expectations.

Read: How FinTech Startups in Nigeria Use Coding Innovatively

Real World Examples of Successful FinTech Apps Built with Flutter

Case Studies of Nigerian Fintech Apps Developed Using Flutter

Nigerian fintech apps have rapidly emerged in the tech landscape, leveraging Flutter’s capabilities.

Several successful applications showcase the effectiveness of Flutter in delivering financial services.

Below are some notable case studies:

- Carbon: Formerly known as Paylater, Carbon is a leading fintech app that provides quick loans and investment opportunities.

Built using Flutter, Carbon stands out for its user-friendly interface, rapid loan processing, and integration with various payment platforms. - Kuda Bank: Kuda Bank, often referred to as the “bank of the free,” eliminates traditional banking fees.

The app offers unique features like budgeting tools and instant transfers.

Flutter played a significant role in Kuda’s development, enabling rapid deployments and consistent performance across devices. - Flutterwave: Although primarily a payment processing platform, Flutterwave also offers a mobile app for merchants.

The app simplifies the payment process and provides analytics tools.

Flutter’s cross-platform capabilities contribute to its efficient design and responsive user interface. - Paystack: Paystack, now part of Stripe, offers seamless payment solutions.

While the main services are web-based, their mobile app built with Flutter provides businesses with a convenient way to manage transactions. - Paga: Paga allows users to send and receive money easily. Its intuitive design and robust functionality stem from being built in Flutter.

Paga focuses on everyday usability and getting transactions done quickly.

Key Takeaways from These Success Stories

The success stories of Nigerian fintech apps like Carbon, Kuda Bank, and Flutterwave reveal several key takeaways:

- User Experience Matters: Each app places a strong emphasis on user experience.

Smooth navigation and intuitive designs encourage user engagement. - Cross-Platform Availability: Flutter’s ability to produce apps for both Android and iOS saves development time.

This cross-platform support allows these apps to reach wider audiences without compromising performance. - Rapid Development Cycles: Developers can deploy updates and new features quickly using Flutter.

This speed is crucial in the dynamic fintech landscape of Nigeria. - Community Support: Flutter’s growing community provides invaluable resources.

Developers benefit from shared knowledge, plugins, and tools that enhance their applications. - Scalability: These apps are built with scalability in mind. As user demand increases,

Flutter’s architecture comfortably supports growth without significant rewrites.

Features That Led to Their Success in a Competitive Market

Several features drive the success of fintech apps built with Flutter in Nigeria’s competitive market.

Here’s a breakdown of essential features:

- Intuitive User Interfaces: Successful fintech apps prioritize clean, user-friendly interfaces.

Flutter’s widget system enables visually appealing and responsive designs. - Speed and Performance: Users demand quick, seamless interactions.

Flutter ensures high performance across devices, allowing smooth page loads and fast transactions. - Robust Security Measures: Security is crucial in finance apps.

Features like secure payment methods and encryption protocols build trust with users. - Real-Time Transaction Updates: Users value instant transaction confirmations and balance updates.

Real-time notifications improve satisfaction and engagement. - Integrated Financial Tools: Budgeting, financial tracking, and investment tools keep users engaged.

These features empower users to manage their finances effectively. - Personalization: Tailoring user experiences boosts engagement.

Data analytics help apps offer personalized recommendations, enhancing retention. - Seamless Communication Channels: Chatbots and customer support features resolve issues quickly.

Effective communication improves customer satisfaction. - Localization: Adapting content to local customs and preferences fosters acceptance.

Successful apps localize features to meet Nigerian users’ needs. - Marketing Strategy: Effective fintech apps use innovative marketing, including social media, influencer partnerships, and referral programs to grow their user base.

- Vibrant Community Engagement: Engaging the community fosters loyalty.

Successful apps participate in local events and offer educational resources.

In fact, fintech apps developed with Flutter in Nigeria thrive due to intuitive designs, security, and scalability.

These apps excel by focusing on user feedback, innovation, and community engagement.

As the fintech sector grows, developers should use these examples to meet user needs and expectations.

Read: Creating Apps That Serve the Nigerian Market

Best Practices for FinTech App Development

Importance of Following Regulatory Compliance in Nigeria

In Nigeria, adhering to regulatory compliance is vital for FinTech app development. T

he Nigerian financial landscape is governed by strict regulations.

These rules ensure consumer protection and maintain financial stability.

Developers must familiarize themselves with relevant laws.

This includes the Central Bank of Nigeria’s regulations and the Nigerian Data Protection Regulation (NDPR).

Failure to comply with regulations can lead to severe consequences.

Penalties may include hefty fines or legal action.

Additionally, non-compliance can damage your brand’s reputation.

Therefore, consider these key regulations:

- Central Bank of Nigeria (CBN) Guidelines: Understand the guidelines for operating payment platforms.

- Nigerian Data Protection Regulation (NDPR): Protect user data and ensure privacy is a priority.

- Anti-Money Laundering (AML) Laws: Implement strategies to detect and prevent money laundering.

- Consumer Protection Laws: Provide transparency in transactions and protect consumer rights.

Overall, a thorough understanding of these regulations is necessary.

It helps in aligning your app development with legal standards.

This commitment builds trust with consumers and stakeholders alike.

Make regulatory compliance a core aspect of your development strategy.

Strategies for Ensuring App Security and Data Privacy

Security is paramount in FinTech app development.

Users entrust their financial data to your platform, making privacy critical.

Employing robust security measures can safeguard user information from breaches.

Consider implementing the following strategies:

- Data Encryption: Use strong encryption protocols to protect sensitive data.

SSL/TLS for data transmission is essential. - Two-Factor Authentication (2FA): Implement 2FA to add an extra security layer for user accounts.

- Regular Security Audits: Conduct routine security assessments to identify vulnerabilities.

- Secure APIs: Ensure all application programming interfaces (APIs) are secure.

Use authentication methods like OAuth 2.0. - User Education: Educate users about safe practices.

Encourage strong password creation and awareness of phishing attacks.

Adopting these strategies bolsters your app’s security architecture.

Consequently, this approach enhances user trust.

It also minimizes potential financial losses from data breaches.

Continuous Integration and Deployment Practices with Flutter

Flutter is an excellent framework for developing FinTech apps.

It offers smooth performance and a pleasant user experience.

However, implementing continuous integration and deployment (CI/CD) practices is crucial for success.

Here are several best practices to consider:

- Automated Testing: Integrate automated tests for building features.

It ensures that changes do not break existing functionalities. - Version Control: Utilize version control systems like Git.

This practice helps manage code changes efficiently. - Build Automation: Use CI/CD tools such as Jenkins or GitHub Actions.

These tools automate the build process and eliminate human errors. - Deploy to Staging: Always deploy updates to a staging environment first.

This setup allows for testing without affecting end users. - Monitor Performance: Integrate monitoring tools to track app performance.

This analysis aids in identifying bottlenecks.

By adopting CI/CD practices with Flutter, you streamline the development process.

It also enhances your ability to deliver reliable updates swiftly.

This agility in development positively impacts users who expect regular feature updates and bug fixes.

Following best practices in FinTech app development is non-negotiable.

Regulatory compliance ensures your app operates within the legal framework.

It protects both your business and users.

Security measures are essential to maintain user trust and privacy.

Users must feel confident when sharing sensitive information.

Additionally, leveraging Flutter’s capabilities with CI/CD practices is crucial.

It allows for efficient coding, testing, and deployment.

Balance these aspects well, and you will create a successful FinTech app for Nigerians.

In this rapidly changing market, keeping user needs and regulatory demands at the forefront will lead to success.

Future Trends in FinTech and Flutter

Predictions for the Future of Fintech in Nigeria

Nigeria stands at the cusp of a financial revolution, led by innovative FinTech solutions.

The increasing adoption of smartphones plays a pivotal role.

Here are some key predictions for the future of FinTech in Nigeria:

- Increased Digital Payment Adoption: Cashless transactions will dominate as more Nigerians embrace digital payment platforms.

- Rise in Decentralized Finance (DeFi): DeFi will gain traction, providing more financial independence to users.

- Enhanced Regulatory Framework: Regulators will create better frameworks for FinTech operations, promoting transparency and security.

- Expansion of Financial Inclusion: More people, especially in rural areas, will gain access to financial services via mobile technology.

- Integration of AI and Machine Learning: Advanced technologies will enhance user experience and service personalization.

- Growth of Cryptocurrency Services: The popularity of digital currencies will prompt more platforms to offer crypto-related services.

How Flutter is Evolving to Meet the Changing Demands of the Market

Flutter is rapidly evolving, tailored to meet the diverse needs of the FinTech market.

This cross-platform framework brings significant benefits.

Here’s how Flutter is adapting:

- Enhanced UI/UX Design: Flutter allows for visually striking and engaging user interfaces, crucial for FinTech.

- Faster Development Cycles: Its hot-reload feature enables developers to make instant code changes and see results without interruption.

- Cross-Platform Capability: Flutter facilitates the development of apps for both iOS and Android from a single codebase.

- Robust Community Support: A growing community constantly contributes to the development and resource sharing.

- Third-Party Integration: Flutter supports easy integration with various APIs and services that FinTech requires.

- Language Versatility: Developers can utilize Dart, which promotes easy learning and high productivity.

Opportunities for Developers and Entrepreneurs in the Fintech Space

The FinTech sector in Nigeria presents a wealth of opportunities for both developers and entrepreneurs.

Innovators can seize various niches and service gaps in the market.

Here are some key opportunities to explore:

- Microfinance Solutions: Develop affordable financial products targeting low-income users.

- P2P Lending Platforms: Create platforms that simplify lending and borrowing for individuals without accessing traditional banks.

- Personal Finance Management Apps: Help users manage their budgets and savings efficiently through engaging interfaces.

- Payment Gateway Solutions: Build secure payment systems for businesses looking to operate online.

- Insurance Tech Innovations: Design platforms that make insurance products more accessible and understandable.

- Investment Platforms: Develop applications allowing users to invest in various financial instruments easily.

The future is bright for FinTech in Nigeria, driven by innovations and technological advancements.

Flutter’s adaptability positions it as a leading choice for creating impactful applications.

The growing opportunities invite developers and entrepreneurs to revolutionize financial services.

As the landscape evolves, collaborating effectively can yield powerful results.

Ultimately, the FinTech landscape will reshape as it integrates innovative technical solutions catering to market demands.

By leveraging Flutter and understanding emerging trends, you can be part of this exciting journey.

With determination and creativity, the FinTech apps you build today could influence tomorrow’s financial landscape in Nigeria.

Conclusion

Recap of the Significance of Building Fintech Apps with Flutter

Building fintech apps for Nigerians using Flutter presents unique advantages.

Flutter allows for rapid development and iteration, catering to the fast-paced financial landscape.

Its cross-platform capabilities ensure that developers can reach a wider audience in both Android and iOS users.

Moreover, the rich set of widgets and tools simplifies the creation of visually appealing interfaces.

This greatly enhances user experience, crucial in the competitive fintech market.

Encouragement for Developers to Embrace Flutter for Innovative Financial Solutions

We encourage developers to leverage Flutter for creating innovative financial solutions.

With Flutter, developers can quickly prototype ideas and test them effectively.

This speed fosters creativity and helps refine concepts.

The growing Flutter community offers support and resources, making the framework even more accessible.

Embracing Flutter empowers developers to build scalable applications that meet Nigeria’s diverse financial needs.

Final Thoughts on the Potential Impact of Fintech Apps on Nigeria’s Economy

Fintech apps have immense potential to transform Nigeria’s economy.

They can enhance financial inclusion by providing services to the unbanked population.

Additionally, these apps promote transparency and trust in financial transactions.

As more Nigerians access financial services, economic activity will likely increase.

Ultimately, the ripple effect can boost job creation and stimulate local markets.

The synergies created through innovative technology will propel the nation toward economic growth.